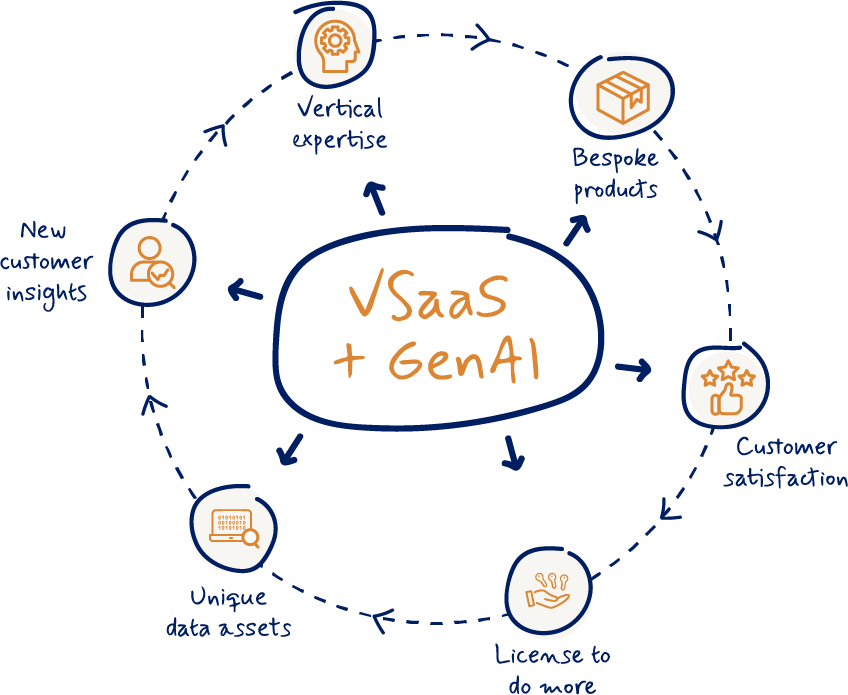

This flywheel demonstrates the accelerating and market defending effect that vSaaS companies generate from their dedicated focus and knowledge of a particular customer profile. This can lead to a best-in-class product, which drives customer satisfaction and creates a trusted brand, enabling the company to grow larger, invest more in its products, and build out its category leadership position.

This flywheel effect is well known amongst vSaaS aficionados like us. However, one of the most frequent oversights when evaluating businesses in the vSaaS category is concluding that TAMs are too small and growth will therefore be short-lived. From what we have seen, market-leading vSaaS companies have continuously disproven this assumption.

In fact, these markets are big enough where we are seeing leaders develop within certain swimlanes. Housecall Pro, a company we recently partnered with, has built a very attractive platform in the small to mid-sized business segment of the home services market. They’ve expanded from a software vendor into a true business partner for clients as they have broadened their offering from a core operating platform to now include everything a home services company needs to run its business. This includes software, fintech solutions, and business services, and is evidenced by an ever-expanding ACV that is representative of the ever-increasing value that Housecall Pro is providing to its customers. Similarly, other markets have bifurcated – for example, within health and wellness, Vagaro and Zenoti have both established strong platforms at either end of the market. The same is true in childcare with Brightwheel and Procare.

This is all enabled by the vSaaS flywheel. Not only does it allow a software provider to win more customers, but it also provides them with a license to do more for each customer, which ultimately leads to increasing average revenue per customer and therefore a larger embedded revenue opportunity and TAM. Vertical depth leads to differentiated product breadth as these solutions become the foundational platform on which their end customers build their businesses.

We have also seen a number of scaled vSaaS category leaders successfully go through this journey: CCC, a provider of software solutions for the automotive industry, has seen the number of customers using 4+ solutions grow by +20% since 2020, which has helped translate into +30% growth in revenue per repair facility since that year. Procore, a construction management platform, has 44% of its total customer base using 4+ products which drives 70% of total ARR.

This natural platform expansion has most recently manifested itself in embedded fintech solutions. vSaaS companies can monetize transaction volume by capitalizing on the benefits of integrated payments or offer tailored lending products where underlying access to customer data creates unique underwriting capabilities.