An effective clampdown in tracking capability is causing a major disruption in the online advertising ecosystem. To succeed, businesses will need to thoughtfully navigate a fast-changing landscape.

Once, television and physical display advertising meant companies relied largely on creative branding techniques to entice customers. The advertiser’s perennial complaint was that they knew half their money was wasted – they just didn’t know which half.

The internet solved this problem and transformed the industry by making advertisements targeted.

The ease and accessibility of going online radically increased advertising supply, prompting the creation of a complex ecosystem of advertisers, agencies, and publishing platforms, all working to efficiently aggregate and match supply and demand.

At the same time, consumers are spending more time online, inherently generating an increasing number of data points. These data points have allowed for highly specific ad targeting and precise attribution showing the impact and results of an ad – both of these facets deliver highly profitable insights for advertisers. As a result, almost three-quarters of advertising expenditure is now digital, according to Statista.

These changes have had some unexpected consequences, however. First, the system relies on the ability to ingest and analyze data to target consumers. Those who could best identify those consumers – namely the largest search and social media platforms, Google and Meta – therefore effectively absorbed the digital advertising market, creating a duopoly.

Additionally, the volume of consumer data points being collected and the number of hands through which they pass have made the system extremely leaky, leading to concerns around consumer privacy. It even became possible to identify individuals by cross-referencing multiple anonymised demographic data points, a practice accelerated by the trading of data between platforms.

Privacy vs policy

While various regulations around data privacy, such as the EU’s GDPR, have impacted the ad ecosystem, the real shift is being driven in large part by some seemingly technical policy changes at major players, Google and Apple.

Google is planning to phase out third-party cookies, preventing advertisers from tracking users as they browse the internet, and replacing them with general, aggregated information on users’ interests.

And in 2021, Apple changed its policy for the tracking of apps, preventing advertisers from automatically tracking users across apps and mobile websites, which effectively severs any observable link between advertising and purchase. The move has made it much harder for Meta to target its advertising. In its place, Apple is introducing tools to allow for campaign-level probabilistic tracking, telling an advertiser whether a campaign probably, not definitely, drove a conversion.

It is no great exaggeration to say that these changes have dramatically altered the industry’s ability to target and track individuals. However, digital consumers can still be reached, it’s just that the balance between third-party and proprietary data has swung heavily towards the latter.

With this, the digital advertising landscape is vastly changing, creating opportunities for those with proprietary, zero-party or first-party data

New advertising strategies

- Several large consumer brands, including the largest retail and hotel chains and video streaming platforms, have begun to monetize their proprietary data directly by developing their own advertising platforms based on their first-party customer data.

- “Retail ad networks” are an emerging phenomenon, whereby retailers allow marketers to purchase advertising space on their e-commerce platforms, using the retailer’s own data to target consumers when they are ready to shop – a model that is accessible even to smaller brands.

- Such models favour ‘contextualised advertising’ that places ads in locations that are likely to be relevant and reach high purchase intent consumers – similar to Amazon’s technique of recommendations.

- AdTech, such as applications using AI, is likely to take off, with more demand to optimize contextual ad placements and create efficiency in this new landscape.

- The proliferation of streaming platforms, with both subscription and ad models, are seen as a powerful way to reach younger consumers and are disrupting the broader ecosystem by attracting spend from TV.

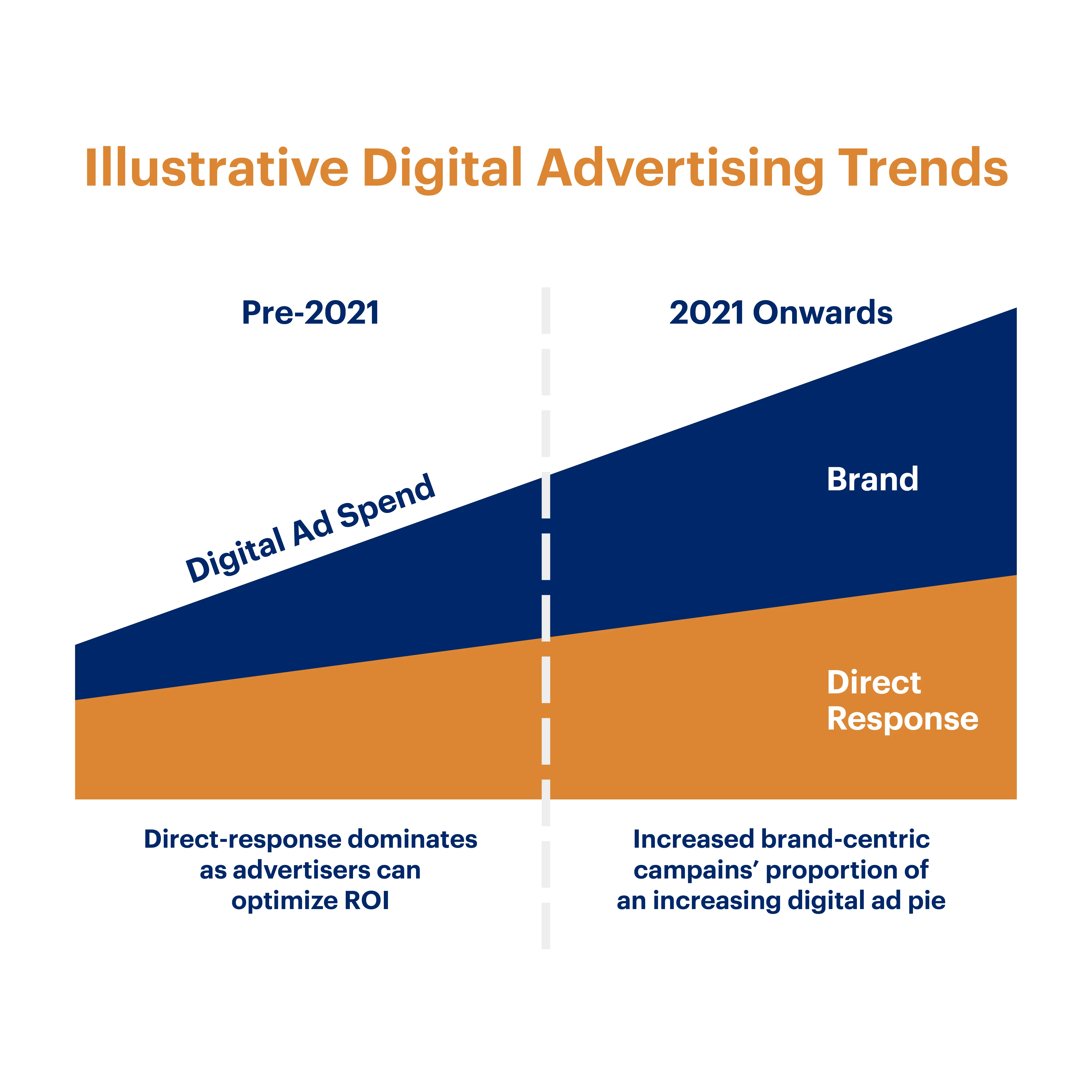

Brand marketing campaigns that build long-term awareness and trust are likely to command a greater share of ad spend than specific-sales focused advertising.